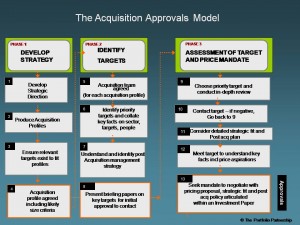

Remember that an acquisition is just one technique to execute your strategy. Acquisitions fail the same way many strategies fail – execution. Research shows us that reasons for failure include: lack of post acquisition planning, attitude of the seller’s management, lack of formal reviews from the last acquisition. There is a safer way to ensure the risks above are controlled. This paper deals with the first two phases of a six phase process -The Acquisition Approvals Model: strategy, identifying targets, assessment of value, negotiation, legal completion, post completion.

Strategy – Defining Targets

- You are clear on your compelling story, you are clear on the unique market you are attempting to dominate, so let it flow through to the type of target you want to buy! The secret to successful acquisitions is to buy what you want to buy not necessarily what is for sale. Practiced acquirers track targets for years before approaching them.

- It is imperative to involve your divisional leadership teams in describing the type of targets that progress your strategy. Involving them ensures the later stage of post acquisition integration is carried out with a positive attitude and passion.

- Revisit if necessary the high priority growth areas, e.g. I would be cynical of a divisional managing director who suggested an acquisition target that would bolster a low performing subsidiary. Prioritize segments where you are operationally world class.

- To save time in academic debate, do a quick and dirty list of targets in all of your desirable segments for growth. Even quite small bolt on targets are visible – e.g. it is quite difficult to hide a $5m software company in the US! In practice you will find that some of your desirable growth segments just don’t have targets!

- The deliverable to this phase is a set of detailed one page summaries for each business segment – Acquisition Profiles (in smaller groups it may be just one profile).

The profile should cover: business profile, key activities, technology, size, geography, ownership, cultural fit, financials, business models, growth, management. Think of it as a shopping list with your preferred attributes of the target noted.

Identifying Targets

- We are not discussing contacting the contacts just identifying the most attractive.

You need to decide whether to involve outside help. I think this varies from case to case. First acquisition? – Outside help can quickly map the landscape for you. - In-house research should focus on making senior staff aware of the acquisition profile and encouraging ideas to be submitted to the central team.

- It is important to establish an acquisition team to coordinate the master list of targets. This team may also have proper day jobs driving the existing business.

- This stage involves collating key facts on the targets and market dynamics. You are starting commercial due diligence, beginning to build a picture of a target. Many myths related to competitors are exposed at this stage. You are building a long list of interesting targets and testing their real fit within your organization. You are mimicking owning these businesses.

- By taking this approach you are addressing one of the key risks of acquisitions- lack of post acquisition planning. The deliverable of this stage is a set of Board Papers with identified priority targets, each with a one page describing the strategic fit. You are asking the Board for approval to contact one or more targets.

- Understand by taking this approach you have the back-story of what to say to the target company. You can explain how and why they would fit into your organization. That’s surprisingly important to founder shareholders who have built an overnight success over the last 20 years!