In Part 3 of my series on Acquisitions the emphasis is on assessing value as you get to know the target and translating that into an Investment Paper that articulates your post acquisition plan.

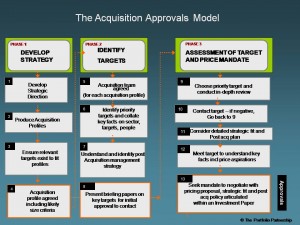

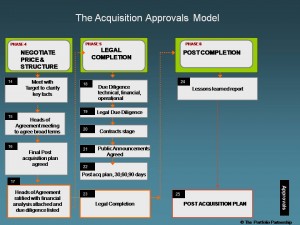

The Acquisition Approvals Process is a six phase process covering: strategy, identifying targets, target contact and assessment of value, negotiation, legal completion and post completion.

Psychology Prior to Contact

The most sensitive subject in these discussions is often price. Remember the following tenet will serve you well:

Buyers perceive value, sellers aspire to price.

Each buyer has a unique footprint that they stand in as they assess value. One buyer may have a comprehensive distribution channel and therefore have limited use for your sales overhead – think Oracle, IBM, Pfizer.

The opposite may be the case where the buyer welcomes your unique reach into say the SMB marketplace and needs your distribution channel. Thus only a buyer is capable of calibrating a unique value to them of owning the target business.

The seller on the other hand is aspiring to price. It’s not the sellers money that’s paying for the deal. The seller might be the majority shareholder and CEO and is being influenced by the proceeds her friend achieved from selling her business or she may be driven by replicating ten years worth of annual income. She is aspiring!

Specific valuation processes are outlined in my Essential Business Briefings #4 here.

Contacting Targets

1. Consider cold calling the owners, principal to principal.

2. A well written letter to the owner’s home address can be effective.

3. Using an intermediary can also be effective but I would recommend the buyer’s name is revealed.

Assuming this contact is successful then acquirers need to prepare for this first meeting. If unsuccessful, please write to the owners expressing keen interest to follow up if circumstances change at a later date.

Strategic Fit – detailed role playing

1. Pull together all the key facts and rehearse obvious questions that you will be asked in this first meeting including; your ability to finance a deal, the strategic fit, the post acquisition plan, the role of the seller’s management. Rehearse your answers as a conversational style rather than as answers to a questionnaire!

2. You will be asked how much you are prepared to pay. Resist this temptation by explaining that you do not possess enough facts to assess value and that a full disclosure of the facts allows acquirers to place a full value on attractive companies.

3. Acquirers need to send the signal that they are professional, reliable people who treat people fairly.

Target Meetings

1. By doing your homework you are entering these meetings in a relaxed state of mind but make no mistake, negotiation has begun.

2. Impress the seller with your knowledge of the market and the sellers competitive positioning in the marketplace.

3. Frame the landscape of why you believe there is a fit and your outline thought for growth.

4. Explain the types of facts you need to gather to assess the potential post acquisition plan and therefore the value to the acquirer of completing a deal.

5. As a helpful checklist of the questions you need answers to it might be helpful to study both my paper on valuation mentioned above and a previous post on post acquisition integration.

Investment Paper to Seek Price Mandate

The culmination of this work will be a Board Paper seeking a mandate to negotiate a deal. This paper allows the Board to review the facts and assess the strategic and financial benefits of a deal. (far better to abort now than at the last minute prior to legal completion)

Think of the audience as a cynical non-executive independent director.

What to include:

- The mandate should articulate the pricing range and key commercial conditions required. Be careful to give yourself some wiggle room. A single price can be too contraining.

- Set out the logic of the price including:

- Profits adjusted to reflect your ownership

- Multiples used -PE basis

- If an earn out deal is proposed, highlight the initial PE and demonstrate that exit PE is lower when the earn-out completes

- Previous deals done in the industry with prices & multiples paid

- highlight specific savings if any you are building them into the logic

- Highlight the ROI

- Articulate at a high level the essence of the post acquisition strategy.

- Articulate the strategic case for the deal – see post on Acquisitions Part 1.

By taking this approach you are dealing with two key behaviors of successful, practiced acquirers:

- Do you really want to do this deal, does it makes sense because its much cheaper to exit now than later

- If I want to do this deal, then before I enter final negotiations on price, I know why I’m doing the deal and what’s its worth to me and only me.