How To Build Shareholder Value

An Operator’s Guide

Over the last 7 years The Portfolio Partnership has helped scale over a dozen New England based businesses, many with overseas markets in Europe and Asia. This paper captures the essence of that work to ensure your teams are working on the right stuff. Aligning resources to ensure shareholder value is being increased is never easy. This guide will illustrate what buyers and investors cherish and therefore how to build value, even if you never execute the sale of a single share.

You believe your business is worth $70m but the buyer thinks it’s worth $30m. You want to place a pre-money value of $40m on your early stage start up but the investors can’t see past $20m. As the owner of a private company you could always compromise and accept that lower valuation. Assuming you have a valuation gap, and you don’t want to compromise, then you’re left with only one option. You need to scale from where you are today.

What do you do?

Recruiting a new COO, CFO or a CMO might help but it’s a gut reaction. You need a wider perspective than that. Let me explain what we’ve been doing to scale our clients over the last seven years.

First, a few facts:

- Every year in the U.S. there are around 6000 deals completed at $10m or more. There are approximately 28 million enterprises in the U.S., and so the odds of selling out at your desired price are not great.

- The psychology of valuation is quite simple. Buyers perceive a value (unique) and sellers aspire to a price.

- Making a business more valuable is an operational problem. Obtaining the best price when selling is an investment banking problem. Don’t confuse them.

At The Portfolio Partnership (TPP) we are closing valuation gaps every month, by deploying operational blueprints that work. We picked up this operational know-how the hard way, over decades of trial and error, curiosity and successfully selling dozens of businesses.

The Saleability Test & Operational Priorities

With every scaling project we start with a test – The Saleability Test. I first published this test in my book, Growing A Private Company in 2001, and the team have continued to tweak the questions from time to time. The essence of the test is to determine the company’s exposure to dependency. Buyers/investors don’t like dependency. It can be dependency on the owner, one customer, a supplier, a coder, a geographic region or a product. Dependency kills deals.

The Saleability Test is a scorecard measuring 15 criteria that influence the value placed on businesses by buyers. Low scores can indicate that a deal is just not possible. Improving your scores on these criteria will make your business significantly more valuable over time. Each test asks the reader to agree with the assertion listed by awarding a scale of

five down to zero, with five being in total agreement with the assertion.

Saleability Test (15 Big Factors Driving Value)

- Your compelling story and results you achieve for customers are clear

- Industry peers see you as top 5 in the industry

- Highest margins in your industry

- Sales & profits growing at 25%

- No one customer accounts for more than 5% of sales

- 3 year horizon shows strong & high growth market

- Legacy products don’t dominate sales & profits

- Top ten managers regarded as world class

- Business is NOT dependent on owner

- Staff moral and engagement are high

- Current year trading and full year forecast > previous year

- Business model produces a sustainable annuity stream of income

- Accounts audited annually by recognized accounting firm

- Legal contracts and filings are in good order

- Significant annual profits, EBITDA $10m scores 5

We take clients through this test to give us a rough guide to where value is leaking out of the business! Each question garners a maximum score of 5 and therefore the maximum score is 75. A score above 60 usually indicates that the business is saleable. So over time, we might objectively score a company in the 30s where it’s probably unsaleable, to a point over time, where it is scoring in the 60s, saleable but being undervalued, and then finally to a point where it is acing the test in the 70s, and is capable of being sold at a premium.

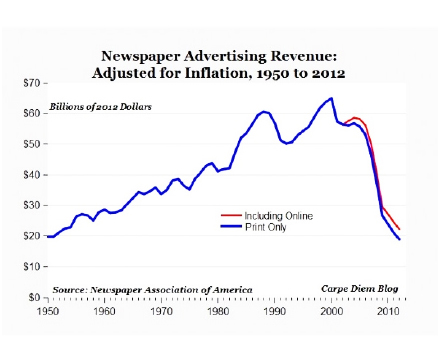

The timing of a deal of course makes a huge difference. Just look at this graph below on Newspaper Advertising (similar story on magazine ad revenue). I was exposed to the timing concept early in my career. In 1987 as CFO of the magazine division, my boss suggested to HQ that Thomson Reuters sell their magazine business. Result? Top dollar achieved. Timing helped. Question 6 above, points at this factor, but its tough to call.

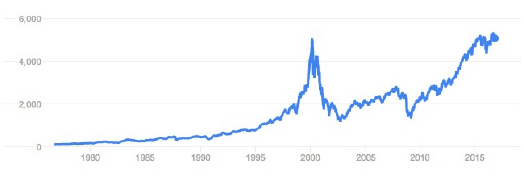

The Nasdaq index gives another picture of timing. Many internet related entrepreneurs made a killing as they sold pre the bubble bursting in 2000.

So timing can make a huge difference to the possible value of your business, but of course that’s out of your control. That’s why you need to push on and drive what is in under your control. Our approach to making a business more valuable is to attack each of these elements mentioned in the test. We work on most of these simultaneously. Let’s review each of these big 15 value drivers and how to move the dial on each of them.

- Your compelling story and results you achieve for customers are unclear. As an example, there are over 4000 software companies in Massachusetts and most of them are mumbling throughout their ill-conceived websites with no perception of how bad their voice sounds! Harsh but fair? That’s just one sector in one state. However it’s true of most private companies. Here’s what I believe. You are either remarkable or invisible. There’s nothing in between. If you’re invisible to your prospects, to prospective employees, to partners then you’ll struggle to build a compelling story of why a larger group should acquire you. Action starts with redefining who you really are. Positioning is the key to success. What place in your prospects head are you trying to fill? By nailing your positioning you are able to align all of your resources behind a single cause. Positioning is about deciding what you are not. Positioning defines your product or service roadmap, your marketing story, your sales strategy and who you recruit.

- Industry peers, journalists, analysts have never heard of you. The company never appears in league tables or honor roles and is never recognized. You’re invisible. Acquirers like to see a target that has a presence in the market. They want to see some endorsement that other people rate you. They want to see that you are credible in the industry and recognized by your peers. Being invisible is not safe. It undermines lead generation. It undermines the credibility of your solution. I’ve never heard of The Portfolio Partnership isn’t a compliment! It takes grit to achieve this recognition. It takes a relentless commitment to place stories, chase recognition and court journalists.

- Competitive margins analysis. Do you know how your margins compare? It can be tough finding out the key ratios of private businesses but it has certainly become alot easier by accessing the new proprietary databases. Use investor slide decks published by public companies to access valuable metrics. Know where you are relative to the competition and initiate improvement programs. Remember buyers and investors have access to the same competitive information so you need to have awareness of your relative attractiveness.

- Your sales and profits are flat, growing slowly or even worse declining. Acquirers don’t want to buy a problem. It’s hard enough integrating remarkable companies (38% are an operational success according to recent PWC research) without having to acquire a problem child. The reality is that no business is actually producing flat results. You’re growing and scaling or you’re declining. And if you’re declining, you will ultimately burn cash and disappear. Get your business on a growth path where extra costs are added but aligned to your top line. Build a stronger, safer business by creating wealth and building market share. Get control of the levers of sales and profit growth and build key performance measures that demonstrate success. In practice we find most management teams don’t invest the time to develop sales processes that focus on a diagnostic sales approach to selling. Based on Jeff Thull’s excellent Diagnostic Selling model, we help build a complete sales process into businesses (primeresource.com). We find that sales growth should never be a problem if you truly understand your customers.

- One customer accounts for 25% or more of your sales. Dependency will kill you. Acquirers hate dependency. It creates risk. Use the cash flow from those big accounts to diversify your customer base and do it faster than you thought possible. Don’t rest on your laurels. What would happen if that one big customer fired you? Scaling a business for safety starts with addressing dependency. It also happens to be a great issue to address if you want to be saleable. Use that key customer to leverage new business. Build a case study using the simple but compelling formula: one page, three paragraphs, covering challenges, solution, results. Prospects respond to stories. Prospects need to imagine themselves in your story. Remember there are only two reasons sales don’t happen. Firstly, prospects don’t believe they have the problem you are solving. Secondly they don’t believe your solution works. Winning a great customer that keeps coming back for more is a great achievement, but if you want to build shareholder value, you must push on.

- Your market segment lacks growth in the medium term. Technology, legislation, consumer tastes, and raw material pricing, can all transform industries for the worse. Change comes fast and hard. Sometimes you need to use that cash cow that you’ve built and transform your business into a more relevant safer play. You need better predictability in your business by reimagining who you are. Shipbuilding, steel manufacturing, analogue devices, PCs, so many industries change over time. Are you ready to reposition before it’s too late? Many software entrepreneurs running public or private companies have had to embrace SaaS. It has not been easy. It’s far more tempting to hang onto that old license and maintenance model. Adobe, Oracle and Microsoft had to embrace SaaS and the world of cloud computing or face extinction. Are you going to change your niche sector over the next five years or be changed by it?

- Legacy products dominate your economics. Acquirers are getting smarter at looking beyond the deal. They are getting better at realizing that post-acquisition costs could turn a well-priced deal into a nightmare. By allowing your business to milk the legacy products without reinvesting in the future, you are creating massive risk. Not only is the business potentially not saleable, it’s also becoming increasingly risky. It takes time to enter new markets and to launch new products. Look at the pain of GE or Cisco transforming their businesses to acknowledge that software (IoT and SDN) is eating everyone’s lunch. Spending money on new products is expensive but doing nothing is even more expensive! Lean heavily into the customers that love you. Let them tell you where they are going. Share investment costs with them wherever possible. Deploy early adopter strategies to validate that you have a real product and market worth scaling.

- Second tier management is weak. Acquirers don’t need great people, they just want your products and your customers. Nonsense! Biggest myth in M&A. The reality is that acquirers are often desperate for new leadership talent. After all, you’ve created something that the acquirer couldn’t. Recruit smart people that are smarter than you. Build focused teams and align them to achieve great things. Weak management teams miss things. They lack gumption (shrewd or spirited initiative and resourcefulness). They miss bends in the road. You don’t need to recruit rock stars to build a great second tier management team but you do need to develop a methodical way of mentoring talent. You need to build world-class internal training programs across all departments using the university model. This model involves creating dozens of one hour courses at various levels, covering essential technical and management skillsets (see blog post, How to build a university inside your business). Bring in guest speakers where necessary.

- Business is dependent on the owner. Bad news for saleability. Bad news for the survival of the business. In the early life of a company, of course the business is dependent on the owner. The business is the owner. However to scale a business successfully, to build predictability into it and create a safe environment, you need to build a team of talented managers and ensure that the unique skills are transferred to a wider audience. This is one of the most difficult things for an owner to action. I had first hand experience of this phenomenon at the start of my career. The founder and sole full time employee of the investment bank I was joining, had tried to scale by recruiting talented young executives, but it hadn’t worked. I made it work and after 5 years we had a mainstream unique corporate finance boutique with a dedicated research team with over 30 staff. We also had nailed the dependency issue, with all 5 directors winning work and executing deals. It’s not easy to achieve but you can’t give up because you have the wrong people. The right people are out there, you just have to find them.

- Staff Engagement. Are your staff motivated? Are they engaged in what they are doing? Do you understand the social science research on why people come to work? Autonomy, purpose and mastery sit above money. We have techniques to focus HR strategies on ensuring these three key elements drive staff engagement. Engagement levels are low as measured by Gallup surveys with only 29% of staff engaged in the US and that’s the best global number! Improving staff engagement doesn’t happen overnight. It starts with aligning shareholder objectives, with corporate objectives and then finally with personal actions. You then start to build ways of allowing staff to get better at what they do (or mastery as we call it). You allow a certain degree of autonomy or “corridors of freedom” as Martin Sorrell (CEO WPP since 1986) stated, and let people own their space. There are also a number of smart mobile apps coming to market that can be very effective at maintaining that crucial touch point between management and staff.

- Your forecasts for this year and next year show a lack of forward progress. Timing is everything. Can you predict sales and profits? If your forecasts aren’t demonstrating great growth, then back off selling. Due diligence is not going to be pleasant. Look at the downgrades in value by the mutual fund industry regarding their investment in start-ups. The WSJ reported recently that T. Rowe’s biggest markdowns of companies valued at $1 billion or more include enterprise-software company Cloudera Inc. at 37%; database-software firm MongoDB Inc., down 23%; and note-taking software firm Evernote Inc., down 21%. It’s never too early to start building integrated financial forecasting models that allow you to flex profit & loss, cash flows and balance sheets to scale your business. The key is to really understand the volume and yield drivers behind the numbers. Financial models should help you understand what just happened. Financial analysis should enable your CFO to explain the stories behind the numbers. By practicing this approach to scaling a business over many years you develop a nose for your business. You sense when it’s off. The ability to capture data has never been easier but the ability to articulate what it means is still a weakness in most private businesses.

- Business models. Does your model produce a reliable stream of income? Will it produce a reliable stream for the buyer? Investors and buyers love reliability and certainty. That’s why they’re in the risk business! Focusing on making your income more reliable with strong annuity income drives shareholder value upwards. Here are six quick ways of improving the quality of your income:

- Look for ways to add a subscription service to your business. It could be a maintenance stream from a contracting type business. Think of the monthly annuity streams earned by Bloomberg terminals compared with one off publishing products sold by analysts. How could you change the way you charge for services to bring annuity streams to your business?

- Look for ways to increase the change costs of your customers to lock them into long-term relationships. Reduce their temptation to change suppliers as new management come and go. I’m talking about long-term supply chain arrangements that benefits both suppliers and customers but also adds some robustness to the arrangement.

- Offer incentives for 3-year maintenance, infrastructure, help desk type services as opposed to your normal 1-year deal.

- Offer to embed a key technical person on site to on-board the customer and wrap a small retainer around that and sell it as an assumptive close. This is how we well this service i.e. it comes with a technical director for 6 weeks and unlimited support for 12 months.

- Make upgrades to higher levels of service easy and frictionless i.e. easy to upgrade on the web without lots of conversations and red tape.

- Look for ways of attaching royalty type payments as the customer sells more of their product or service.

- Accounts audited. It’s all about risk mitigation. You don’t want surprises as you run the business. Consider auditing your accounting and IT systems by a credible external accounting practice at least once a year. It has the additional benefit of bringing credibility to your operations in the eyes of investors and buyers. It highlights early potential due diligence issues you might face much later. Smart acquirers are considering post-integration much earlier in the process, long before due diligence (as suggested in The Acquirer’s Playbook, Amazon, 2015), which means they are requesting a credible financial pack of information in early meetings. Are you ready to answer those early meeting questions when the time comes? In practice, we find few private company management teams are ready for any form of due diligence. Start running your business like a public company (without the shortterm thinking bit) and you will always be ready to answer questions.

- Legal contracts. Patents, leases, employment contracts, supplier agreements and shareholder agreements to name but a few are all important to get in order. You are taking exposure off the table. You are building a strong negotiation platform for yourself, if you choose to sell one day. We recommend conducting a small but focused legal (including employment) contract due diligence which reviews what’s in place and what is missing. We’ve seen glaring omissions in partnership agreements, lease agreements, shareholder agreements which could cause havoc during a sales process. We’ve seen unique technologies with no patent protection. We’ve seen employment contracts with terms that would cause nightmares for an acquirer. Why live with these exposures? Even if you never sell the business, it’s just common sense to ensure that you are protecting your assets.

- Your absolute profits don’t cut it. In most cases, the bigger the profits the bigger the multiple you attract (if you are declining or growing slowly all bets are off). At profit levels below $3m EBITDA, it can be very difficult to get a deal away. It’s just not worth an acquirer’s time to invest resources if the deal doesn’t move the dial. Sure there are exceptions e.g. some specific technology targets fill an essential need and because their stuff actually works, the buyer is keen to bring the target into the fold. However in general, size matters. Most private companies under $3m EBITDA are lurching from payroll to payroll. Building absolute profits builds safety into your business and allows you to invest in essential technology, processes and people when it matters. Private companies can quantum leap their growth curve by considering a simple little technique – acquisitions. Many sectors contain well-run small businesses that would make a great addition to a larger private company. Often these small companies are too small for a big public company to deploy resources to own them. Consider small bolt on acquisitions to scale your business and acquire some great talent. Finding the money to complete the acquisition is rarely the problem.

SUMMARY

It’s easy to work on the wrong stuff. Setting out a blueprint that directs talent to work on the right stuff is essential. Deploying the appropriate operational protocols, systems, measurements and organizational structures makes a huge difference to building shareholder value. Scaling a business to increase value contains key elements including control, alignment, predictability and safety. When scaling is done well, stakeholders see a strong alignment between actions and corporate objectives. They notice higher levels of controls around essential functions of the business. Predictability becomes more accurate and forecasting achieves higher levels of credibility leading to a great place to work and a financially safe company to join.

About The Portfolio Partnership (TPP): We are an operational consultancy that scales businesses organically and by acquisition. Our biggest added value? We align effort with strategy. Working on the right stuff is a game changer. We work alongside your leadership team to deploy our methodology and playbooks to implement a rich process of discovery, analysis and action. We transfer our know-how over time to your team, maximizing their performance. Scaling is not the same as sales growth. There’s more to it than that.

LinkedIn: https://www.linkedin.com/in/iandsmithca