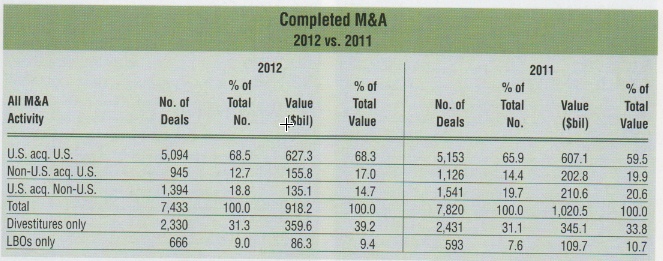

The new M&A tables are out for 2012 from ACG courtesy of Thomson Reuters. These tables trap all deals done in the US over $10m. I’ve poured over the detail and extracted some conclusions:

Conclusions

- In 2012 the draft number above implies 6039 deals were completed involving US sellers. Approximately down 4% on 2011’s total of 6279.

- Average deal value in 2012 from these sellers was $130m.

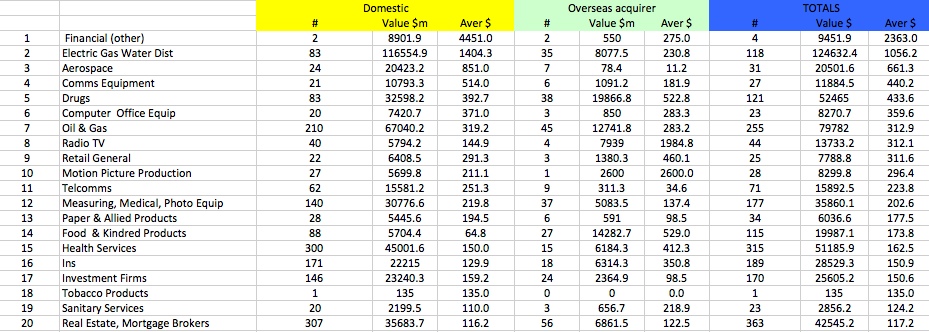

- The highest average deal value came from the Financial Sector at $2.4Bn from 4 deals.

- The lowest average deal value came from the sector Personal Services at $1m from 25 deals. These were less than $10m on average because some would have involved minority stakes.

- On average overseas acquirers paid $165m covering 945 deals compared with an average of $123m per deal for US acquirers from 5094 deals.

- A summary of the top sectors by deal value is as follows:

Overall the scary part for the owner of an SMB is how rare the exiting for $10m or more is. Given the 5.9m firms who run a payroll in the US, the statistic to ponder is that only 1 in 1000 of you will sell out for $10m or more in any year given these tables.

Very enlightening. M&A and business owners need to be paying attention. If the odds truly are 1/10th of 1 percent of $10million businesses sell in a given year, owners need to focus on improving their odds. Making the business stronger, saving money outside of the business, getting a personal plan for what they want to accomplish, and finding the right advisors to guide them, are all critical.

So true Paul. Owners of private businesses are often brave, skillful entrepreneurs but to truly scale a business to give yourself the option of selling out one day often needs help. In today’s market I believe there are more skillful advisors than ever before but you need to really want to scale. If you don’t that’s ok but there are consequences.

Best

Ian