As the CEO, it’s easy I hear you say, just increase sales or reduce costs or both!

Brilliant. However on the basis that your operational team needs more guidance than that, I’ve listed a few ideas to get your juices flowing. A few ideas worth considering to leverage your existing footprint.

Scaling an Operational Cell

Are you building a marketing and sales cell that can be replicated anywhere in the globe? A lead generation machine and sales closing team that is so slick and effective, working to a set of protocols that it could operate anywhere. An operational blueprint capable of delivering repeatable success. Details are everything. The operational blueprint will need to be tweaked from territory to territory. Clearly exporting a protocol from Boston to Tokyo is more challenging than exporting it to say London, or is it? You still need to set out a lead generation plan, a recruitment strategy, an onboarding strategy, teach your sales process, delivery translated collateral (even phrases that work in the States may need tweaking for the European market eg an RFP in the US would often be called an ITT in Europe, Request for Proposal v Invitation to Tender). Once you have a working cell, there is usually an attractive opportunity to replicate that somewhere else. Different selling territories exhibit surprisingly similar behavior if you are brave enough to try.

Zero Based Budgeting Approach

Costs creep on over time and before you know it your business is totally misaligned. Costs and sales are out of step. This is a moment in time where you have to stand back and say I’m changing our approach. I’m making this a 5% or a 10% or a 15% net profit to sales business. I know I can sell say $10m this year. I know I can make 60% gross margin of $6m on that sales figure and therefore to make 10% net of $1m, I can only AFFORD $5m of overheads. That moment of conviction changes everything. It drives you to find cost savings everywhere. It acts like a catalyst to drive a root and branch review of all costs. It demands you ask the question, if I was starting this business tomorrow from scratch what could I do without? This does not necessarily mean cutting heads but it will definitely mean cutting costs that do very little to facilitate sales.

Volume & Yield Tactics

By understanding the volume and yield drivers behind your sales figures and those of your competitors you may spot a better way to come to market. Think of the battle between Nokia and Apple. Nokia dominated the volume argument but only made $10 on every phone. Apple made more money selling a small percentage of Nokia’s volume but made $180 profit on every phone! Now when was the last time you looked at your pricing model compared with your volume model. Could you make changes to your model to make more money?

Acquisition Costs of Sales Leads and Customers

Measuring the ROI on all lead generation activity is essential. Was that trade show really worth the investment? Did that workshop generate any real business? Did the production of that white paper bring us real business? These are all key questions. However just as important is the tracking of lead acquisition costs month in month out. An upward trend is not a scaleable business. Rather critically the WSJ commented in a recent article, referring to Groupon, the daily offers company that recently listed, ” Critics pointed out that Groupon was unprofitable and was spending heavily to acquire new subscribers amid a flood of competition from daily-deal clones.” If you are a growing private company with rising lead generation costs per lead you are building trouble for tomorrow and indeed many early stage VC businesses run out of runway to turn that trend around.

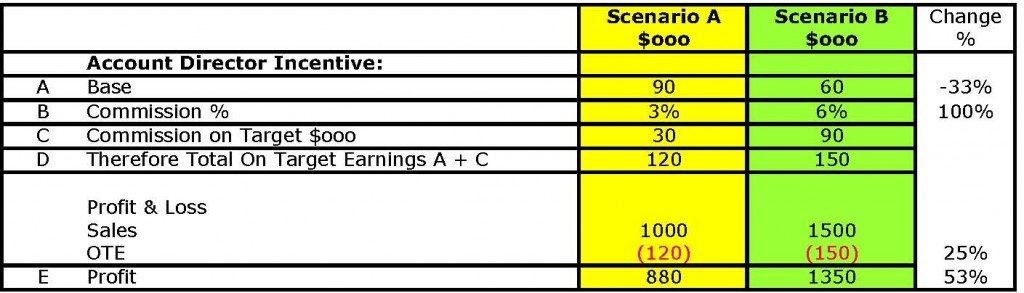

Restructuring Sales Commission

I’ve reviewed, created and lived with a plethora of sales incentive schemes over the years. Biggest problem: disconnect between the psychology of the formula and the commercial objectives of the scheme. Symptoms range from, base salary % of Total On Target Earnings (OTE) being > 70%, math way too complicated, lack of clarity on how it scales, the commission payout is paid too long after the sale. By tweaking the OTE package you can increase profitability and achieve a more highly motivated sales team. If a salesperson comes to you complaining their base is too low, then they are looking at the wrong end of the problem but only assuming you’ve cracked the appropriate incentive scheme. The following worked example illustrates this final point. Imagine your current sales team are on a base salary of $90k plus 3% commission. A more appropriate reward structure might be $60k base and 5% commission. Scenario A is the present scheme. Scenario B is the new proposed scheme. At $1m sales achievement both schemes pay out $120k OTE. However if you can incentivize the sales team to deliver higher levels of performance by doubling the commission % from 3% to 6% to say achieving on average $1.5m sales not $1m then everyone wins. The OTE increases 25% and the profit of the company quantum leaps 53%.

These are just a few examples to inspire you to build a more profitable business that ultimately is more robust and predictable.

Now don’t forget to vote for my little orange book, one click vote, 10 days to go – Vote button under here