In Part 4 of my series on Acquisitions the emphasis is on negotiating a deal and ensuring you really understand how you will manage the acquired business.

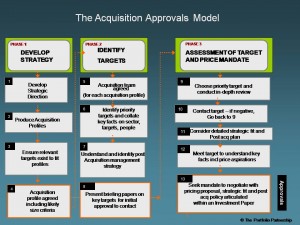

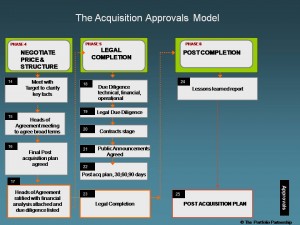

The Acquisition Approvals Process is a six phase process covering: strategy, identifying targets, target contact and assessment of value, negotiation, legal completion and post completion.

At this stage of an Acquisition you are entering a dangerous phase of emotional attachment. Be careful to continue auditing the signals.

You have signed off a price mandate with your Board, you have a post acquisition plan on paper and now you need to enter this final phase of negotiation confident of the type of deal that works for you.

It is unlikely that you have reached a preferred bidder status so this phase is all about getting to that preferred, exclusive status or walking away.

Meet with Target to clarify key facts

Prior to a final Heads of Agreement meeting I would recommend a more informal meeting to clarify a bang up to date situation on these topics:

- Latest full year forecasts

- Current trading

- New customer wins

- New hires or resignations

- Assets or shares being purchased

- Any exclusions from the sale, assets, subsidiaries, patents

- Personal objectives of the seller, price, service contract, role, promises he has made to staff etc

- Market and channel strategies

- Status of pipeline

- Status of cash flow

- Any operational issue impacting on your post acquisition plan

Assuming you feel, certainly pre formal due diligence, that you have all the key facts then move to a formal Heads of Agreement Meeting within a week.

Heads of Agreement Meeting

In a previous blog post, Negotiation Tips, I set out 17 quick tips to achieve great results for these types of meetings and specifically for Heads of Agreement Meeting I offer this agenda:

- Update since last meeting: it is vital to clarify even at this late stage any change of information which effects the deal. I’ve seen dramatic events hit a business only days after a previous meeting.

- Confirmation of what is included: it is possible that misunderstandings still exist especially private assets of the owners e.g. the Aston Martin.

- Earn -out formula and period: too often in deals, due to time pressure or other reasons, earn-out deals are not clarified in sufficient detail through worked examples.

- IPR: Acquirers must ensure that the relevant IPR is owned by the target company and not by individuals or companies outside the target group.

- Removal of personal guarantees: the removal of these guarantees should be sold as a benefit of the deal but are often overlooked

- Key warranties and indemnities: although an issue to be discussed in detail at the contract stage, it is a great opportunity to spell out the key ones the buyer will expect to see in place.

- Purchase price and consideration: I would keep this down the agenda until you have achieved some momentum to the meeting. I would merely add this thought to previous thoughts on pricing, you should adopt a “no regrets” policy.

You do not want to lose the deal by low balling only to see a competitor close the deal at a price you thought fair! On the other hand if the business is worth $30.5m to you then that’s it. - Exclusivity: as acquirer you want to establish an exclusivity or lock-out period to allow due diligence to take place without a competitive threat. 8 weeks is an acceptable exclusivity period to completion.

Great stuff Ian. I tweeted this and posted to my LinkedIn group