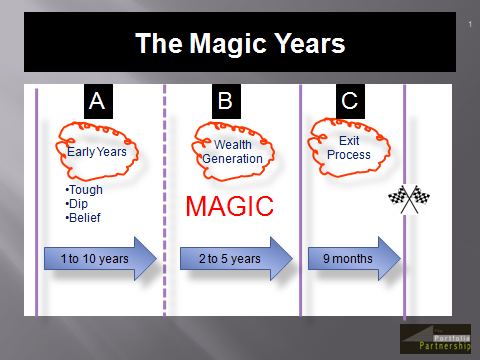

Back in January, I introduced you to the concept of The Magic Years. A period of time when you can really build value in your company. A period of time when your objective is to define and dominate your space.

The timing of the Magic Years is decided by you and your team. It’s not for the fainthearted.

Wealth is not being created

It is disappointing to me but not surprising that 90% of private company value is created by 5% of the companies. This is what statisticians call a power law distribution. It is not surprising to me because private companies are either invisible or remarkable and most are invisible. Very few are in between. Businesses are either commodities or monopolies and most are commodities. I know that sounds harsh but too many owners are sleepwalking their way to value! Evidence suggests that increasing shareholder value is a challenge.

Here are some facts, according to Mergers & Acquisitions magazine there were 5568 US exits last year with a value of $10m or more. The total number of US firms from the 2008 US Census data is around 27.3 million. Therefore if you are an owner of a small medium sized business, the probability of selling out for $10m or more is 1 in 6000.

And it doesn’t seem to make a difference if you are enormous and listed on the public markets. Leslie Hannah, a business historian at the London School of Economics, analyzed what happened to the world’s largest companies (as measured by stock-market value) between 1912 and 1995. Full paper here.

The winners more than made up for the losers, but most didn’t win. By 1995, only half the 100 largest concerns survived in their original form; fewer than one in five stayed among the 100 biggest; and only a third finished larger than they began. The rest shrank, died or got digested by other companies. Adjusted for inflation, the typical blue chip finished the period at only 40% of its original market value.

There seems to be a regular pattern at play here. There seems to be an inevitable company lifecycle. You start with the Early Years followed by the Middle Years and eventually to the Declining Years to oblivion.

So is decline inevitable? Can we change this pattern?

Yes we can but it requires a different mindset.

The Solution

It demands you insert a new phase into the company lifecycle – The Magic Years. This is a special time where you create a business that is growing fast, is fun to work in, moves to a dominant position in its niche and is very attractive to buyers. The Magic Years occurs after those Early Years and gives you a dedicated pathway to success, knowing you are building a business that is not just saleable but saleable at a premium exit value.

So how do you create these Magic Years? This requires you as the owner to think big. To think like the Big Boys! So what changes? How do you create a remarkable business? What do you do differently? You build a business with a new insight. You build a business by looking through the lens of a buyer.

You need to recalibrate value achievement around a new scorecard – a new set of 9 Big Critical Success Factors. You need to Deploy Integrated Tactics. Over the coming weeks I will explore each of these in detail bringing out practical action plans to achieve success. I will share some great playbooks, business models and tips that work in the real world to deliver a more predictable, enjoyable way to run a business.

The “Magic Years” are where the real wealth is created. Now you can’t measure it every day at 4pm like a public company but if you can consistently nail these 9 Big Critical Success Factors, trust me you are driving shareholder value (defined as how much a buyer would pay for your business today) through the roof.

As an introduction to future blog posts, I’ve laid out the 9 Big problems I want to help you solve:

9 Big Problems

- How does a business build an attractive positioning and translate it into a compelling marketing narrative?

- How do you create a high growth sales environment with world class repeatable sales processes and a well trained sales team?

- How do you build innovation into your culture and ship award winning products?

- How do you attract the best talent and nurture them?

- How do you build a metrics culture that is relentlessly curious?

- What are the best business models and how could you improve yours?

- How do you raise venture or private equity money and beat the odds?

- How do you minimize risk and build robustness into your business as it grows?

- What is the best process maps and tactics to complete acquisitions and integrate them seamlessly?

The Portfolio Partnership team have generated over $500m of liquidity for shareholders over the last 25 years by deploying integrated tactics to solve these problems. Reach out, give us a call to discuss your objectives.

New web site, new partners and a new book are all coming soon.

Join the conversation – Ian