We love Process Maps at The Portfolio Partnership. Models that have been stress tested in the field. I’d like to dedicate the next few blogs to one of my favorite Process Maps – The Acquisition Approvals Model. Like all my blogs I’m going to share it with you.

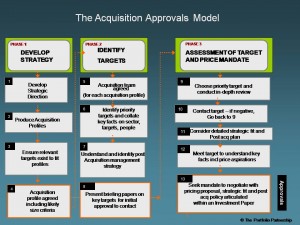

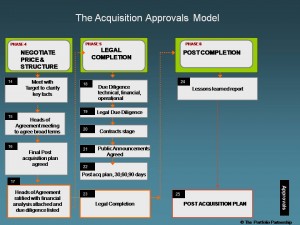

This is a Process Map you can embed in your your own business without spending a ton on consultants. I’ve used this process in over 20 acquisition assignments. The order is important. Six phases with a key approvals stage at the end of each phase. Six phases are Strategy, Target Identification, Assessment of Target & Price, Negotiate Price & Structure, Legal Completion, Post Completion. This post is focused on Strategy.

STRATEGY

- Develop Strategic Direction – I can’t stress enough the importance of understanding who you are, what your core competencies are, because getting that wrong can be fatal. You need to be damn sure you can integrate the target and that you can run it better than the seller. Remember you are not just buying the house you are buying the family inside it! You want to buy what you want to buy not what is up for sale. Acquisitions are just a tool of strategy not a strategy.

- Produce Acquisition Profile – This is your shopping list of poster children. The targets you would like to buy, not names but ideal characteristics.

- Quick & Dirty Search – It is important to check quickly that targets exist that match your precise shopping list. e.g. one initial acquisition profile described an IT Governance software company with sales in excess of $50m in a geographical region and produced zero targets. Think again. Or a generic set of characteristics for distribution companies produced 1000′s of candidates – refinement clearly was needed.

- Acquisition Profile Agreed -Therefore it is now possible to sign off on a measured shopping list which reconciles to an attractive strategy with sufficient initial targets.This profile is a powerful document.

This phase can take weeks or months to get right but you can see the measured preparation that went into that. You are forcing management to consider post acquisition integration and fit with the current core business right out the blocks! Instead of looking all starry eyed at what is for sale you are ripping the emotion out of the process and focusing on the type of companies that fit well inside your comfort zone.

Future posts will dive into Phase 2 to 6. Workshops are available on the Acquisition Approvals Process throughout the year.