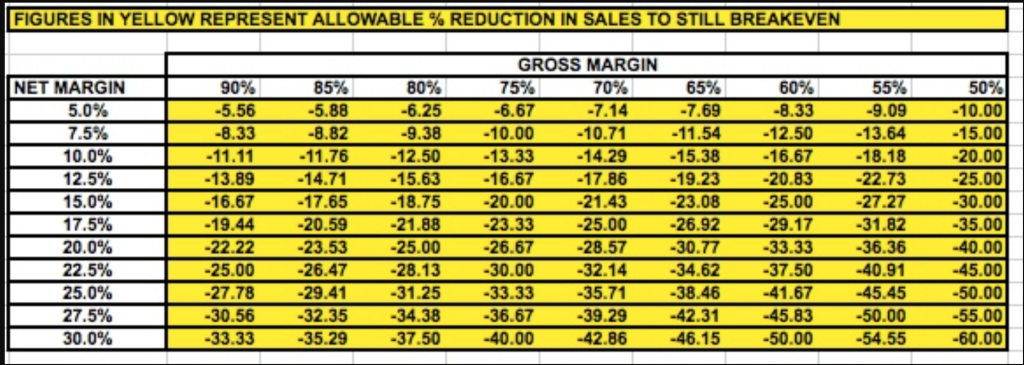

A little classic today that you can do at home! Every business has a different set of economics but every business has one common element, they all have a break-even point. First, establish your Gross Margin %. That would be your sales less your variable costs = Gross Margin, then divide that by sales, the Gross Margin %. Do the same for net margin, by taking your gross margin less all the fixed costs. Take this net margin and divide it by sales, thus establishing the Net Margin %. Find yourself in the table below. That tells you how far you can afford sales to drop before you lose money or bleed.

Worked Example

Say you make 80% Gross Margin and 15% Net Margin, on an annualized basis, your sales could drop 18.75% and you would still break even. Proof, Sales are say $50m, reduced to $40.62m, GM now $32.5m, FC were $32.5m, still breaking even. It basically shows you that in high fixed costs businesses you can’t afford to lose too many sales or of course, you need to cut that breakeven point down to size!

To ram home the point, take the top left-hand corner of the table representing a high fixed cost business, Net Margin % of 5%, you can only lose 5.56% of your sales despite your high gross margin. Take the bottom right-hand corner of the table representing a low fixed-cost business, Net Margin % of 50%, you can afford to drop 60%.

Scenario Panning

Of course, once you master the break-even points you can play with scenarios.

- What’s the impact on earnings before interest (EBIT) if I increase my GM% by 2 points?

- What’s the impact on EBIT if I increase sales by 10%?

- What’s the impact on EBIT if I cut my overheads by 5% and still deliver my products on time and at the same quality?

I find it’s always useful to understand just how sensitive your business is to fluctuations in sales. This is especially true of software businesses where high operational gearing means that once you’ve set up your infrastructure you can really scale quickly and turn in some great margins.

The Portfolio Partnership provides a range of acquisition support services tailored to your business needs and team size. As an operational consultancy, we assist clients in both organic and acquisition-based growth. We are either building a programmatic acquisition program into our client’s business or we are working on operationalizing the business to accelerate growth organically. Either way, we are passionate about building shareholder value. It is fractional corporate development management through the lens of an operator. We seamlessly become an extension of your team and integrate at all levels to fulfill the potential of the business. We create a strategic plan together with our clients and design a set of actions aligned to that plan. We then assist in the execution of those actions to add significant experience and bandwidth to the team. Our work leads to a successful M&A whether buying or selling.

Contact Ian@TPPBoston.com