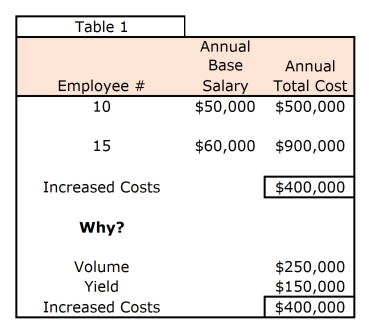

The financial analysis of a business can seem complicated but there really is no need for this complication. Every financial story in any currency, in any sector, and in any business model boils down to two things! Volume and yield. Let’s take a simple example of a small business that increases its staffing from 10 to 15 and gives them all a pay rise. How would you explain that in volume and yield terms?

Well, using the worked example in Table 1, you have employed 5 more people causing a $250k volume impact and you have given 15 people a $10k higher salary causing a $150k yield impact. Now some people may say, look your salary bill was $500k and now its $900k and so we have increased costs by $400k. But understanding the volume and yield drivers helps you understand the economics of what is happening to make better decisions. For example with no salary increases, costs would have risen by $250k, due to pure volume reasons. This analysis isolates the drivers to see their impact instead of just netting this together.

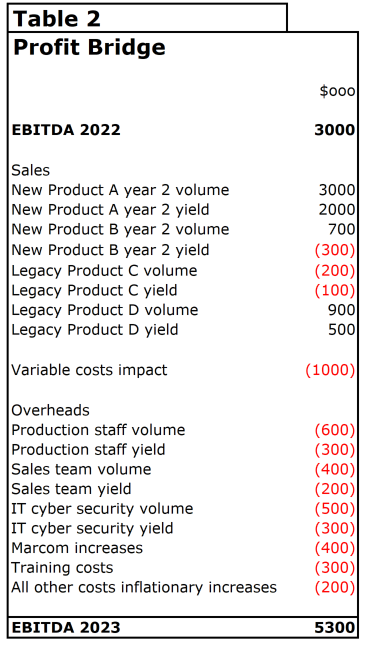

A practical way of using this technique is in the budget or forecast cycles. Say you wanted to add credibility to your profits jumping from $3m to $5.3m. By using volume and yield drivers you can create a bridge statement. This leads the reader through a journey of change. It explains the impact of policies on your profits. Table 2 shows how a range of policies will increase profits from $3m to $5.3m. Obviously, this is a simplified model but it illustrates a great way to tell your story. Each significant policy is isolated to demonstrate the impact on the new financial year compared with last year. Most people are intrinsically comfortable with a delta from A to B. In this case, you are explaining based on a historical result, namely an EBITDA of $3m, how you will produce an additional $2.3m in profits.

Anyone can see that sales and profits are up or down but the key for leadership teams is to understand why.

The Portfolio Partnership provides a range of acquisition support services tailored to your business needs and team size. As an operational consultancy, we assist clients in both organic and acquisition-based growth. We are either building a programmatic acquisition program into our client’s business or we are working on operationalizing the business to accelerate growth organically. Either way, we are passionate about building shareholder value. It is fractional corporate development management through the lens of an operator. We seamlessly become an extension of your team and integrate at all levels to fulfill the potential of the business. We create a strategic plan together with our clients and design a set of actions aligned to that plan. We then assist in the execution of those actions to add significant experience and bandwidth to the team. Our work leads to a successful M&A whether buying or selling.

Contact Ian@TPPBoston.com