Building businesses that buyers love to buy or investors love to invest in or banks love to fund is all about economics. Building a remarkable business is impossible without understanding how your business makes money.

The ability to explain in simple, clear terms the finances of your company will allow you to build a metrics culture that will transform the agility of your team. It will give you and your team a common currency to better understand the issues impacting your decisions.

A few basics first:

- A balance sheet is a snapshot in time of your assets and liabilities. A balance sheet can’t cover a month or a week or a year. It is a picture of an instant in time e.g. as at Dec 31, 2010.

- A profit & loss account and cash flow statement merely explain the difference between 2 balance sheets.

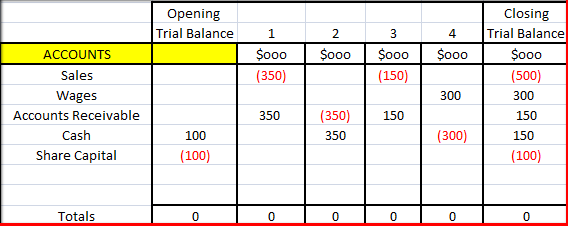

- Let’s illustrate this principle using 4 transactions:

- Sales of $350k

- Cash received of $350k from those sales

- Sales of $150k

- Wages of $300k

- Assume the business started the year with $100k in the bank from the owners and they own $100k of shares. So the books show an opening trial balance as shown. We then process all 4 transactions to arrive at a closing trial balance as shown. Non brackets are debits and bracketed numbers are called credits.

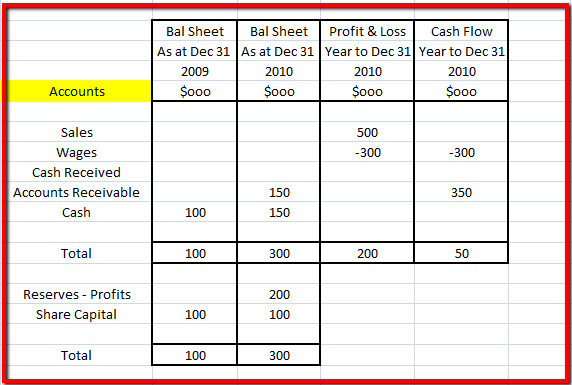

5. If we now look at how these transactions appear in balance sheets, profit and loss statements and cash flows we can see how the entire accounting system works.

The difference between the 2 balance sheets therefore is firstly profits of $200k – as shown in the Profit & Loss and secondly the cash balance has increased by $50k – as shown the Cash Flow.

The analysis of a business really leans on these fundamental principles. The key is to build financial systems that that produce meaningful reports that tell the stories behind your trading results.

Forecasting

One of the issues that owners of private companies will hit if they ever try to sell the business is the weakness of their forecasting models.

Acquirers love their forecasting systems. They build budgets, cash flow forecasts, scenario planning, pricing models all around their detailed models. Integrated models using sophisticated spreadsheets with embedded macros and pivot tables are the norm.

The more you model your business using these models the better you become at forecasting. I would encourage you to build your budgets using detailed forecasting models that tries to trap all the relationships between your costs and revenue. Really build your budget from the ground up articulating your polices section by section. A forecast or budget is merely a financial representation of the polices you would like to execute to achieve success.

Remember that in business every financial variance between the actual results and say your budget or say against last year can be explained with 2 reasons! Volume and yield. Think about it. If your sales are $1m lower than last year, there will 2 fundamental reasons, you have sold less or more and you will have sold that volume at higher or lower prices. Volume and yield.

Costs go the same way. You spent $200k more on salaries compared with last year. You either paid more people or less people and you paid them bigger or smaller salaries.

Life keeps changing

I like to be able to refresh my full year forecasts for the whole business every month, profits, cash and balance sheets and every three months I would recommend a root and branch review of all your assumptions driving your model.

The key is to audit the signals. Understand the dynamics of your business. Get your arms around the big picture.

Say for example you are running a $20m manufacturing business.

You should be able to describe the trading business in three lines:

- We sell 3333 products at an average of $6000 = $20m

- We make a Gross Margin % of 85% = $17m

- Overheads are running at $15m which gives us a profit of $2m.

Detailed stories can then follow from the headlines. Own the key metrics of your business. Get to know how you make money. Understand the breakeven points. Understand the pricing models that work.

Key Performance Indicators

The technology available these days makes it easier than ever to trap the key variables that drive your business. Build a family of ratios that are relevant for your business and relentlessly measure them. From detailed sales by products, profits by product, to profit by customer. What gets measured gets done.

Get ahead of the curve and understand in advance when trouble is brewing. And as important, understand why you are successful. What is driving your success? Is there an operational blueprint that can be replicated elsewhere to turn around your troubled children?

Building this type of metrics culture will develop your staff into rounded businessman and give you insight to generate a more attractive business.

Of course it will make a due diligence process so much easier when the time is right.