Last week in the FT John Authers wrote a compelling piece on the M&A market worth summarizing for all CEOs and those involved in acquisitions. These are some of the main points with my own observations:

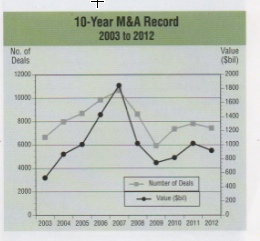

- M&A activity in the US last year reached 7433 transactions well below the peak of 10651 in 2007 (Thomson Reuters).

- When it comes to valuation, companies do not buy at the bottom, but when valuations are already above average. John Authers suggests several reasons: strength of the acquirer’s currency, difficult to make bold decisions when things at their worst and companies are bad at timing when they buy. As noted above the peak of 2007 preceded the biggest financial crash in history! The previous peak? You guessed right – 2000 as the Nasdaq bubble burst. As John says, Like everyone else, CEOs buy high and sell low.

- Academic research is pretty damming on the success of acquisitions. Projections for enhanced earnings per share are missed. Post acquisition integration proves harder than the spreadsheets suggested. As I often say, talk to me about synergy by all means but tell me how much, who is going to deliver it, by what means and by when? Then I might believe 50% of it on a good day. A classic finding from the literature – 70% of deals fail to add value.

- Research from Credit Suisse suggests European dealmaking over the last 12 months has been 64% below its 10-year average.

- The good news possibly fueling more activity is of course the cost of debt is low. Also gearing is below the 20 year average of 1.73 with net debt 1.47 times EBITDA globally (Credit Suisse).

- Further research from Absolute Strategy suggests that deal activity tends to expand ahead of pick-ups in corporate earnings. CEOs feeling their companies might be earning a bit more should encourage a relaxing of the moratorium on acquisitions.

- So it looks like more deals are coming and acquirers would be wise to start screening for possible targets with strong cash generation and low leverage. Remember an essential part of successful acquisitions is to buy what you want to buy not necessarily what’s up for sale. Build your one page Acquisition Profile that reflects your shopping list. This will list the type of deal you want to pursue and one that fits with your strategic goals.

In summary an acquisition is a great tactical tool, to facilitate a quantum leap in your growth. However every acquisition requires exceptional preparation and remarkable execution to be successful.

Further Reading

Acquisitions Part 1

Acquisitions Part 2

Acquisitions Part 3

Acquisitions Part 4