Let’s be clear. Losses are not sustainable for any company. Amazon founded in 1994 made its first profit in Q4 2001. For years the eCommerce giant made losses. In fact Bezos famously stood up at an analysts meeting to announce Amazon had made a profit but then said I discovered it was a rounding error!

A serious quote from him on profitably is more on point. “A company shouldn’t get addicted to being shiny, because shiny doesn’t last. It’s hard to find things that won’t sell online. We expect all our businesses to have a positive impact on our top and bottom lines. Profitability is very important to us or we wouldn’t be in this business.”

The secret of higher margins is actually a mindset. If you believe you deserve to make say 10% pre-tax margins then go do it.

It’s really as simple as keeping fixed costs fixed as you scale. As operators we’ve executed turnarounds, high growth start-ups and more mature growth plays. Our partners have been exposed to high-tech manufacturing, software, materials science, IT recruitment, transportation businesses, media, ad agencies, and publishing to name a few. In operating in these sectors globally we’ve attacked target markets like aerospace, defense, semiconductors, healthcare, financial, construction and utilities.

Margin improvement comes from the ability to scale your operations whilst keeping fixed costs fixed as long as possible.

The starting point is to calculate the current break-even point from your operations.

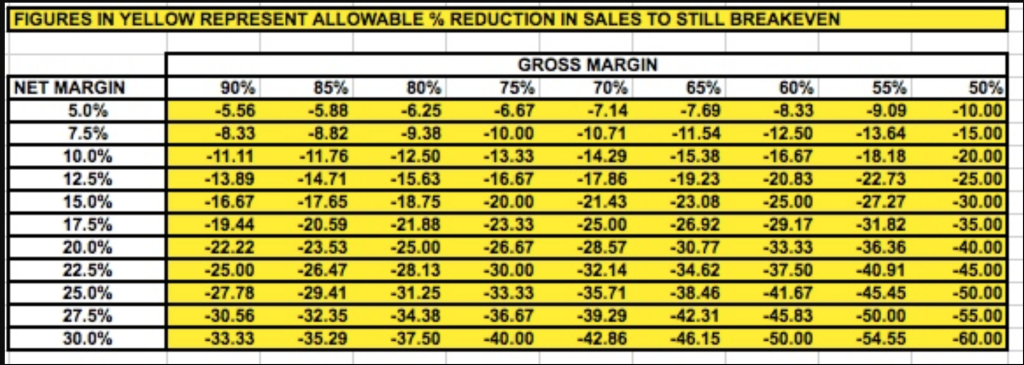

For example if you are running at say $30m in Revenue and your variable costs are running at $20m annually then you are producing a $10m Gross Margin (GM % 33%). Assuming your Fixed Costs are $10m then your breakeven point is Revenue of $30m. The relationship between GM % achievable and Fixed Cost levels drives your pre-tax margins (Net Margins in table below). Every business in any sector of any size succumbs to these rules!

Understanding the margin impact of increasing Revenue or decreasing Revenue (Called Sales in table) is an essential operator skill.

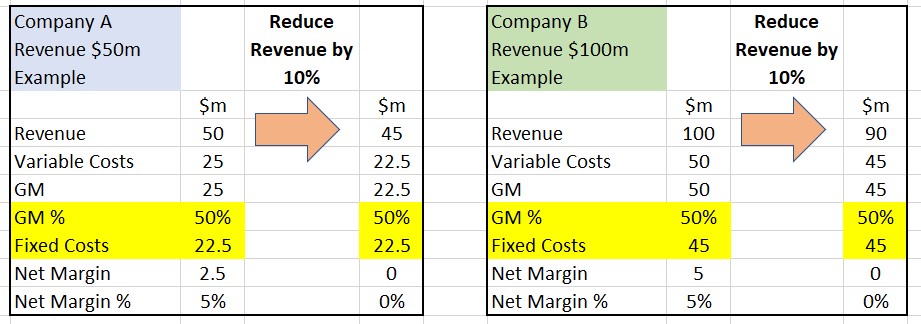

Worked example time. Let’s prove the table above by looking at 2 scenarios. Assume both companies exhibit the margin characteristics in the top right of the table. Both companies have GM % of 50% and both have Net Margins % of 5%. If Revenue drops by 10% in either case, you still achieve breakeven.

Equally you can work out the math of what is required to get to your target margin if you understand the breakeven point. In company A, if you were running at $45m in Revenue (see above far right column of Company A) and you wanted to make 5% Net Margin, you would need to increase Revenue by $5m. Or you would need to cut Fixed Costs by $2.5m eg Revenue $45m, GM $22.5m, Fixed Costs $20m, Net Margin $2.5m and Net Margin % equals 5%.

Playing with different tactics

There are many policies worth investigating once you have the model set up. For example:

- What happens if you discontinue your least profitable service/product lines?

- Are all global regions profitable? Exit some regions to see the impact on your margins.

- Which variable costs, including labor, materials, energy, transport could you reduce to move the GM% up?

- How could you transform your fixed costs to improve non billable costs?

- Utilization rates of consultants

- Higher quality leads from your business development team

- Lower fixed and higher variable element of the sales team’s pay

- How could you bring in more Revenue from the existing customer base without increasing fixed costs

- Could you spin off some activities into a Joint Venture and change the economics of the business?

- Could you outsource some services you currently do in-house?

- Are your pricing policies leaving money on the table (I’m not suggesting gouging customers).

- Can you charge for some pre-revenue services eg design services, audit and discovery work?

- Have you looked at the complete cycle from quotations to cash to tease out value leakage?

- Are there still manual processes being done inefficiently instead of being automated?

- Are your quality engineers targeting lower warranty claims?

The reality is that targeting a Gross Margin % or a Net Margin % is a state of mind. If you started your business tomorrow, what would you spend money on? Of course there are limitations depending on the sector. You can achieve Net Margins of 30% plus in software because I did it. On the other hand achieving 10% Net Margin in a construction business is tough.

In summary build out the economics of your business. Model it and play tunes. Gather competitive data to compare your performance and get to work.

The Portfolio Partnership is a fractional senior management team of operators. We help owners “build businesses buyers love to buy” by deploying our successful playbooks. We seamlessly join your team to work on the right stuff.

As always if you found these insights useful please share.

Ian@TPPBoston.com