In this second post I thought it would be useful to share some benchmarks covering, On Target Earnings, call stats, and cookbooks depending on the sales model you choose.

1. On Target Earnings.

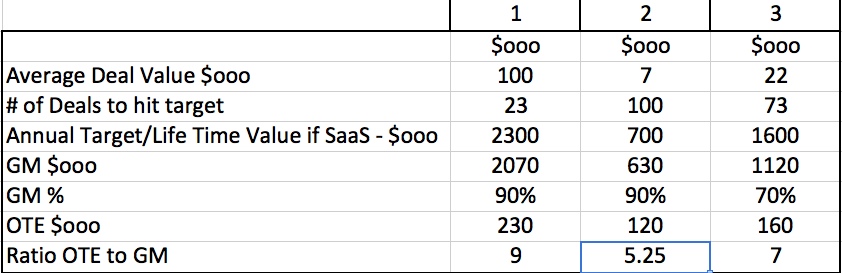

I published a detailed blog on sales commission here but I’ve summarized the issues you need to resolve in this table. Basically you are trying to decide what ratio is appropriate for your business between OTE (On target earnings including commission) and the gross margin of the sales target. Here are three examples with ratios from 5.25 to 9 to illustrate the point.

If you take a classic software business in scenario 2 with a low overall deal average of $7k you will probably need to pay $60k of a base in the current market and the opportunity for the sales professional to double her money. Thus OTE of $120k. That would produce a ratio of 5.25. This should allow plenty of scope to pay for all costs related to acquiring new customers. The sweetest spot of all (ignoring zero sales people and a web based selling model) is where your average deal is $100k. Here I would argue that an OTE package of $230k would be fair with an annual quota of say $2.3m. The ratio of margin to OTE is 9. But of course that model is likely to involve an element of outside sales with face to face meetings and thus travel costs that can add up fast. But with right sales process I believe these deals can be closed most of the time on the phone. Just don’t expect high volumes of calls from this model. Then you might be running a manufacturing/technology business with GM% of 70% or less in scenario 3. Again this is likely to be mainly phone based selling with some site visits to land and expand. The ratio can still be very attractive as a business model at around 7. With a monthly SaaS model in the software sector, annual targets are effectively the lifetime value of every customer (LTV). Of course this presumes you are myopically measuring attrition rates. If those customers don’t renew after 6 months or a year or a month, you will overestimate LTV and over-reward.

2. Operational Metrics

What is a reasonable number of calls to make in a day or what is a reasonable duration time to expect every day? Well it depends on the model. Even an outside sales model with high travel time needs to communicate by phone. But at a senior level you really need to measure the progression of the pipeline rather than the number of dials. More on that below. However for scenarios 2 & 3 above that are far more transactional and volume based, you absolutely need to measure volume of calls and duration using an automated system. I’m always amazed how difficult it is to achieve even 40 calls per day. Equally we all have 8 to 10 hours per day at work but getting 3 hours of quality time on the phone is tough. However metrics have to be driven and conversations have to remain high quality. Good averages for me based on scenario 2 would be daily calls of 50 and duration average of 2 hours. In scenario 3 probably target number of calls per day nearer 20 and call duration of 1 to 2 hours (usually much more work before and after calls with $20k to $30k deals). Trend lines are the key and reconciling what is working for each sales professional.

3. Sales Pipeline

So often we hear about the importance of CRM systems. Whilst we need a system, they are useless without a sales process that allows you to measure velocity – the speed of progressing deals through the process to Purchase Order. It’s always fascinating to me when I embed the Prime Process in a sales team how it immediately shows up the sales professionals who can’t crush pipelines. It’s often not intentional but by graduating deals through an appropriate 4-stage process from Discovery, Diagnosis, Design and then Deliver/Proposal to PO you see instantly where the blockage is. Are close rates weak? Are sales professionals able to to graduate out of Diagnosis? We also place weighted % on each stage, 0%, 10%, 50% and 75% after the proposal is sent. This gives us great weighted pipelines every few days, which gives us visibility of where the month and quarter are heading. Give each sales professional the tools to self manage, to master their business and you will succeed. A weighted pipeline figure for the month should be at or above target by day 20 of the current month or you are looking at failure.

There are literally dozens of relevant benchmarks to be reviewed when scaling a sales team. The most important point is to work out for your business the key ones that if nailed, will deliver a business that is scaling profitably and safely.

4. Cookbooks and Roadmaps

Another important benchmark to establish with your sales team is the recipe for success. How many deals do each salesman need to close to hit target? How many deals therefore need to be in the sales funnel and at what stage to ensure the monthly target will be met? Once established the question then becomes which specific deals am I taking to the bank? And what’s my Plan B, my Plan C, my Plan D! Great sales professionals achieve consistent results by having an options strategy. They have established 5 ways to get to their $400k monthly target.

The final post will address some practical execution issues you will encounter when scaling sales.