A new M&A report was issued last week from the International Business Broker Association (IBBA), Pepperdine Private Capital Market Project and M&A Source highlighting the latest US activity. Thanks to Rose Stabler for the heads up. The report interviews all relevant M&A brokers intensively to uncover the activity of deals in the $500k to $50m space.

Main conclusions worth understanding:

- Valuations are staying strong.

- Sellers are gaining greater leverage.

- Boomer retirement driving sellers to market.

- Traditional lenders back in the game, supporting smaller PE players and individuals to fund deals.

- In the $2m to $5m segment, most buyers were individuals at 47% of the total.

- In the $5m to $50m segment, about 60% by buyer volume were PE players.

- In the sub $2m segment, biggest reason cited for the deal – “buying a job”.

- In the $2m to $5m segment the main driver behind the deal was horizontal add on e.g. buying related businesses.

- Vendor aspiration on price and lack of patience were cited as the main reasons for deal failure.

- In the $5m to $50m segment there was a huge increase year on year in mezzanine financing. Q4, 2012 mezz made up 3% of financing jumping to 26% in Q4, 2013.

- Deal timetables shrunk dramatically in the $5m to $50m comparing Q4 2012 with Q4 2013, going from a median 12 months to five!

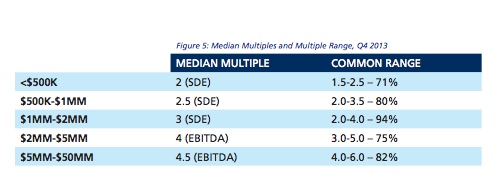

- Exit values in terms of EBITDA multiples seemed way too low to me.

I suppose it depends whether you are buying or selling but expect to pay significantly higher than these multiples to acquire a remarkable business. Note: The sample size was 238 respondents (M&A brokers/advisers) from 38 states.

Read our latest free Exit Playbook – Click on the image to download: