Most entrepreneurs start a business to create something valuable whether they bootstrap it from Day 1 or launch through seed capital and/or venture capital. The type of funding will influence the exit process. External funders will expect an exit. If the business is self funded, you get to decide if you ever want to exit.

However here is the flaw. In most entrepreneurial minds, the owners believe that bigger and better will lead to an exit one day at a price that allows a very comfortable retirement. It’s a myth. 90% of businesses are not ready for a sale. Talk to investment bankers about how many of their mandates fail to get away, the business fails to sell. Most entrepreneurs are NOT building a business that will be transferable, and that will be sold for a premium figure.

Again most entrepreneurs imagine building a bigger business that employs many more people than just themselves. Here is the reality of US entrepreneurship taken from the latest US Census data:

- There are 27 million nonemployer businesses (one that has no paid employees, has annual business receipts of $1,000 or more and is subject to federal income taxes). Nonemployer businesses are generally small, such as real estate agents and independent contractors.

- In addition, there are 6.1 million employer businesses that run a payroll.

- 63.7% employ 4 people or less

- 90.0% employ 19 people or less

- 98.3% employ 99 people or less

- 99.7% employ 499 people or less

Out of that general population of 33 million firms in the US, around 7000 to 10000 will exit per year for a value of $10m before tax. Pause for a second to consider these facts. I believe it demonstrates how few companies scale to any size and exit at a premium value.

What is preventing scaling?

What is stopping entrepreneurs building businesses buyers love to buy?

- Is it a lack of courage?

- Are entrepreneurs not working hard enough?

- Is it a lack of passion for their business?

No, it’s very rarely any of this stuff.

No, the main reason is that most entrepreneurs are chasing the wrong goals, measuring the wrong stuff, not measuring the right stuff.

In a nutshell they are looking through the wrong lens!

- They are looking through the lens of a seller.

- Instead of looking through the lens of a buyer.

The Model that builds big exits

Private Equity applies this model on every portfolio company and TPP partners have been using this model for over 30 years, successfully making companies safer, turning them around, building them for exit. It’s a value creation system. It works down a set of priorities starting with positioning and your unique story that will resonate with prospects. The model is executed through a framework we call operational excellence or if you like “how we do things around here”. The model attacks value leakage issues. It goes after issues that screw up exits, issues that cause your business to be unstable! The model fixes and polishes what buyers cherish.

Real Examples from our careers

Here is a cross section of examples and the fixes we pulled off:

Investment bank: Dependent on the guru owner. Built a team of professional deal makers who could win work and execute deals. Diluted the impact of the business being reliant on one man. Successful exit > $10m

Die Bonder: Weak storytelling, horrible website, no marketing department, no sales process, dependent on legacy products. Built a new website, hired a new marketing team, designed and executed new playbooks for marketing and sales, and product launches. Rebuilt the brand, launched new market leading products, and developed a new range of KPIs across the organization. Successful exit for tens of $millions.

Software Tools: Loss making but high growth software tools servicing the Lotus application space. Reimagined the positioning around a governance agenda, rebuilt the sales team, introduced playbooks across marketing, sales, product road maps and finance and transformed margins from losses in excess of $1m to EBITDA of $3m. Bought out VCs, sold to management.

HR Outsourcing Business: Lacked operational controls and onboarding of clients. Built internal protocols, designed due diligence files and established key customer focused teams. Premium exit in $millions.

Aerospace specialist manufacturer: Weak European expansion. Transformed reach and access to Airbus through a French acquisition in a deal that kept leadership and managers in place.

Material Testing Equipment: No marketing or sales playbook. Revamped the sales and marketing processes, developed playbooks, transformed the storytelling, new business development initiatives, new incentive schemes. Built a new platform for scaling the business. Remains a safe, growing independent leading player.

Summary – Lessons Learned

The key to value creation is to look at your business objectively. That requires a new scorecard.

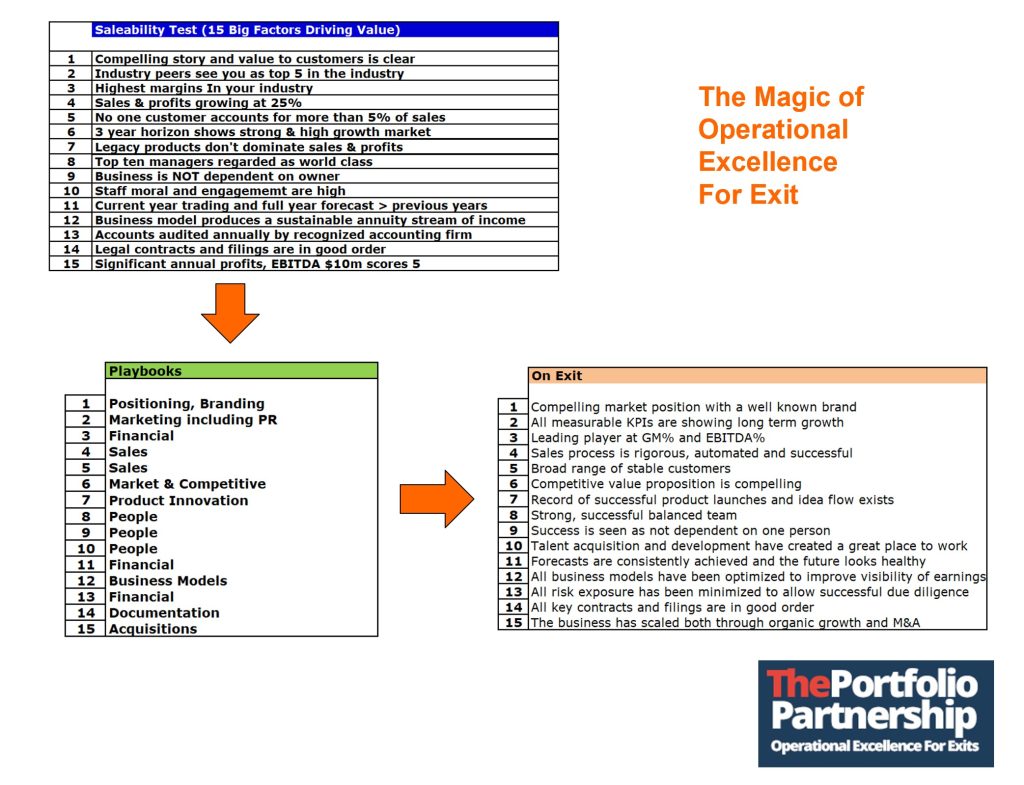

Here is a picture of what it looks like:

By using the Saleability Test to assess a company’s readiness for exit, you uncover value leakage and where to invest your resources. As you put in place new protocols the secret is to document how you do things around here. So Sales, Marketing, Finance, Products, M&A all get their own playbook. This shows existing staff and new employees the process to follow. It also allows investors or acquirers to validate the way you do things when the time is right.

This is a picture bringing the Saleability Test, Playbooks and Outcomes all together.

This approach develops the attributes a buyer cherishes but as important it builds a safer, scalable business that employees and customers will love.

This journey can take 2 to 5 years, but it’s guaranteed to transform your vision into a remarkable business that will be transferable one day to new owners if you so choose.

Entrepreneurs rarely get what they deserve. Do something about that. We are here to help.

The Portfolio Partnership is a fractional senior management team of operators. We help owners “build businesses buyers love to buy” by deploying our successful playbooks. We seamlessly join your team to work on the right stuff.

As always if you found these insights useful, please share.

Ian@TPPBoston.com