As you build your business each year with higher revenue and hopefully profitably, it may seem a reasonable assumption that the value is constantly increasing and that you could sell it one day.

You would be mistaken. Approximately 90% of private companies coming to market are not ready for primetime. These companies will attract little interest and are highly likely to see buyers walk away long before due diligence.

The main reason lies in the owners flawed approach to building value. Bigger is not necessarily better. Failing to continually invest in new products may save you money and produce attractive cash flows for a period, but it kills long term value. And doing every key element of your business yourself may be satisfying and fun (if a little stressful) but it’s not creating a business with long term sustainability. Owners are not looking at their business through the lens of a buyer to assess the company’s readiness to enter a sales process, and exit the other end with a great deal for shareholders.

We take a different approach. We build an Options Strategy with our clients not an Exit Strategy. We want our clients to have the option to sell their business in two years if they so choose. That way you build a business buyers love to buy. We see the job to be done as, scale a business that is saleable even if you never sell it.

So when and how does this journey begin?

Discovery Audit – The Saleability Test

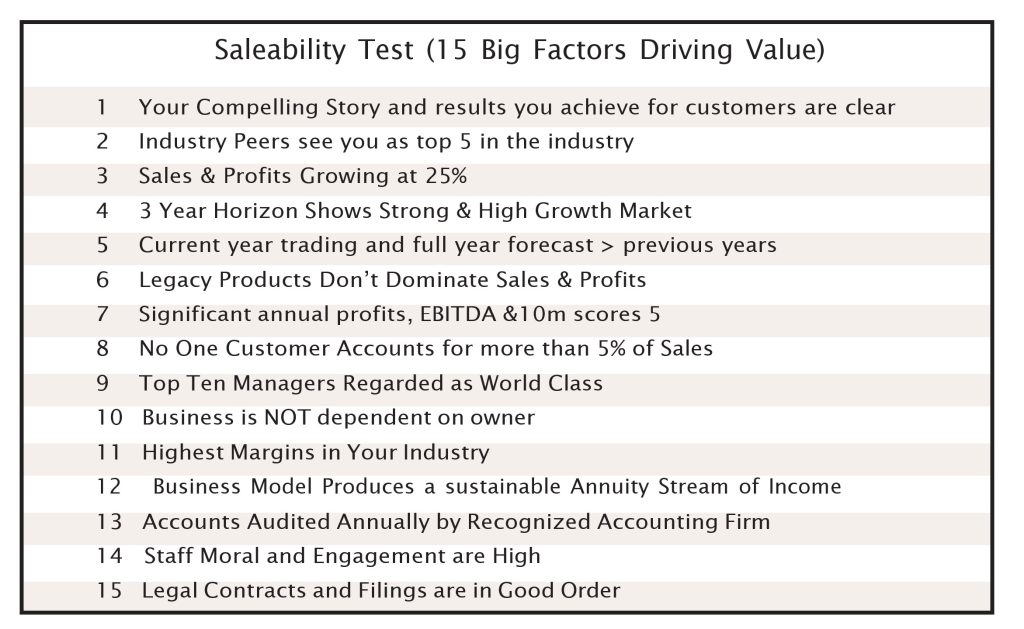

A great place to start is to audit your company’s readiness by taking the Saleability Test. This is our proprietary system that tests the status of your business against 15 factors that buyers cherish. These are issues that cause buyers delight or pain! These are characteristics the buyer will inherit and own if they complete an acquisition of your business. Low scores in this test are indicators that buyers will walk away from a deal. Low scores are telling you that there are items that need to be fixed. So by auditing your business using this test, you are viewing your business through the lens of a buyer. The test is invaluable in assessing whether you are creating an enduring legacy rather than a paycheck for you and your employees.

We have used this test as a predictor of the success of “cashing out” at attractive prices. Those companies scoring 60 or above were almost always sold at a premium valuation. Give yourself a maximum score of 5 if you strongly agree with the assertion and zero if you totally disagree.

Notes to Help You Answer the 15 Big Questions

- Use your judgment but be honest with yourself. Does your compelling story come through clearly? Is it obvious what your business does and how it benefits customers? Have you crafted a strong positioning statement?

- Again, it’s up to your judgement. Are you seen as a top player among your peers, or are you overlooked?

- To rate sales and profit growth, give yourself 5 points for 25% or more, 4 points for 20% up to 24.9%, 3 points for 15% up to 19.9%, 2 points for 10% up to 14.9% and 1 point for 5% up to 9.9%.

- While it’s ultimately your judgment call, support your answer with market data that can be verified.

- A high score is achieved if the business is on an upward growth trajectory and the current year’s profit forecast indicates that growth will continue at the same rate.

- It’s another judgment call, but for the purposes of this assessment, “dominate” means 60% or more market share.

- Rate yourself 5 points for $10 million in EBITDA, 4 points for $7million up to $10 million, 3 points for $5 million up to $7 million, 2 points for $2m up to $5 million, and 1 point for $1 million up to $2 million.

- Rate yourself 5 points for up to 9%, 4 points for 5% to 9.9%, 3 points for 10% to 14.9%, 2 points for 15% to 19.9%, and 1 point for 20% to 24.99% and 0 points for 25% or more.

- Judgment call. I would encourage a critical assessment of your second-tier management team.

- Use your judgment to assess whether the business could continue to thrive for at least 12 months without the owner’s direct involvement.

- Base your answer on research rather than guesswork.

- Use your judgment but consider what percentage of revenue you can confidently expect to receive over the next six months. A perfect score is achieved if 90% of that revenue is backed by contracts.

- The key is to have your finances audited, but it doesn’t necessarily have to be done by a big four accounting firm.

- Your judgment is important here, but staff surveys can help support your answer. Gallup Research has shown that, on average, only 30% of employees are fully engaged at work.

- Use your judgment, but make sure you have a good understanding of the terms and conditions of your contracts.

Conclusions

- A score of 60 or above implies you own a highly saleable business, however a few low scores on the dependency questions could hurt you.

- A score below 60 but above 46 implies a quality business with a few grooming issues worth addressing.

- A score below 46 but above 30 implies a good business but contains problems that need to be addressed to ensure the maximum exit

- A score of 30 or below implies a business that needs to address some fundamental issues to ensure that shareholder value is not eroded in the short to medium term.

Fixing some of these issues can be a long process, but the reward is a more stable and prosperous business, whether or not you decide to keep it.

The Portfolio Partnership prepares businesses for sale ideally with a 12 to 24 month runway.

Our service line is summarized here. Please download a copy.

Check out our ideas to move the dial on all 15 factors here.